The Top Fintech Software Development Companies of 2024

The financial technology (fintech) industry continues to revolutionize how businesses and consumers interact with financial services. The increasing demand for digital banking, blockchain technology, AI-driven platforms, and advanced security protocols has spurred the growth of fintech software development companies worldwide. These companies are at the forefront of creating innovative software solutions that enhance user experiences, streamline transactions, and ensure compliance with regulatory standards.

In 2024, several fintech software development companies have distinguished themselves with cutting-edge solutions and a strong commitment to innovation. In this article, we’ll explore the top fintech software development companies of 2024 and highlight their unique offerings. Additionally, we’ll discuss Tangent Technologies, a leader in AI-driven fintech software development, and its contribution to the fintech space.

1. Tangent Technologies

Tangent Technologies stands out as a leading fintech software development company specializing in AI-powered solutions. With a deep understanding of the financial sector, Tangent Technologies creates software that automates decision-making processes, enhances customer experiences, and improves financial security. Their solutions are designed to integrate seamlessly into existing systems, offering both startups and enterprises the ability to scale their operations efficiently. When evaluating the top fintech software development companies in 2024, it's crucial to consider their expertise in developing robust, scalable solutions. Whether you’re a startup or an enterprise, finding the best software development company for fintech startups can transform your business.

Tangent Technologies is particularly known for its advanced machine learning algorithms, which power fraud detection systems, risk management tools, and personalized financial planning software. Their expertise in developing AI-driven fintech solutions positions them at the forefront of the fintech revolution in 2024.

2. InstaFinTech

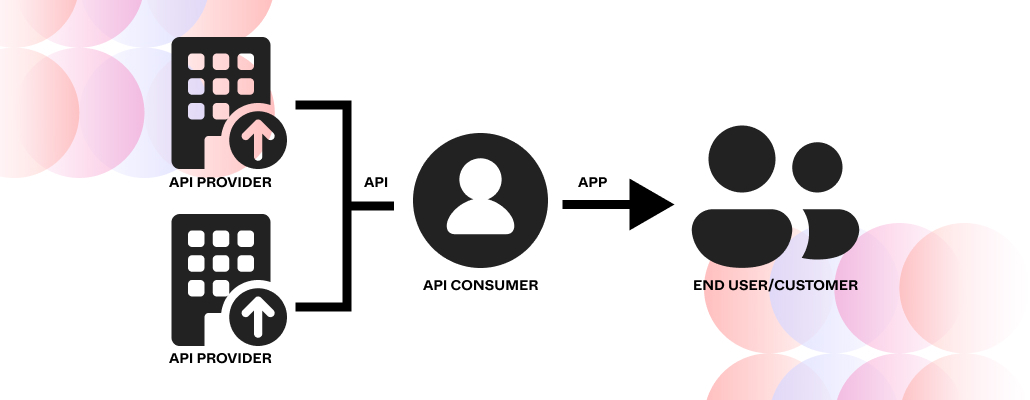

InstaFinTech is one of the most innovative fintech software development companies, offering a range of solutions from blockchain development to digital payment platforms. Their primary focus is on delivering secure and scalable fintech applications, making them a top choice for businesses looking to optimize their financial operations. Their services also include mobile app development, API integration, and smart contract development, which cater to the needs of modern financial institutions.

3. Blockwise Technologies

Blockwise Technologies is a pioneer in blockchain-based fintech software development. Their solutions are trusted by banks, insurance companies, and financial institutions globally for secure and transparent transactions. With a focus on decentralized applications (DApps) and crypto-payment solutions, Blockwise helps businesses embrace the future of digital finance.

Blockwise also excels in creating blockchain platforms that ensure data privacy and security, which are critical concerns in the fintech industry. Their expertise in developing blockchain-powered fintech software has earned them a spot among the top fintech software development companies in 2024.

4. FinFusion Labs

FinFusion Labs is known for its comprehensive fintech software development services, which include digital banking platforms, automated trading systems, and AI-powered financial advisory tools. Their solutions are designed to optimize user experiences, making them ideal for businesses looking to offer personalized services to their customers.

One of the reasons FinFusion Labs is a top fintech software development company is their focus on creating platforms that integrate seamlessly with emerging technologies. From AI and machine learning to big data analytics, FinFusion Labs ensures that their clients are equipped to compete in the fast-paced world of financial technology.

5. QuantX Solutions

QuantX Solutions is a leading fintech software development company that specializes in creating algorithmic trading platforms and financial analytics tools. Their deep expertise in quantitative finance and software development enables them to build robust solutions for hedge funds, asset managers, and investment banks.

QuantX Solutions’ fintech software development services also extend to mobile banking applications, digital wallets, and payment gateways. Their ability to design secure and user-friendly fintech platforms makes them a top choice for businesses looking to enhance their digital presence in the financial sector.

Why Choose Tangent Technologies for Fintech Software Development?

Tangent Technologies is a fintech software development company known for delivering high-performance solutions that leverage the power of AI. From fraud detection systems to predictive analytics, Tangent’s AI-driven fintech solutions are transforming how financial institutions operate. Whether you need custom software for managing financial data, automating workflows, or enhancing customer interactions, Tangent Technologies has the expertise to meet your needs.

By choosing Tangent Technologies, you’re partnering with a team that understands the complexities of the financial industry and the importance of compliance, security, and user experience. Their focus on innovation and cutting-edge technologies has made them a leader in the fintech software development space.

Conclusion

The fintech industry continues to evolve at a rapid pace, and the role of fintech software development companies is critical in shaping the future of financial services. The companies highlighted in this article have demonstrated their ability to deliver innovative, secure, and scalable solutions that meet the demands of modern financial institutions.

Among these, Tangent Technologies leads the way with its AI-driven fintech software development capabilities. Fintech startups often seek a custom software development company for small businesses that provides solutions tailored to their unique needs, helping them stay competitive. Their commitment to innovation and deep industry expertise makes them a trusted partner for businesses looking to stay ahead in the competitive fintech landscape. Whether you’re a startup or an established financial institution, partnering with Tangent Technologies will ensure that you’re equipped with the right tools to succeed in 2024 and beyond.

FAQs

1. What makes a fintech software development company stand out?

A fintech software development company stands out when it combines technical expertise with industry knowledge. Companies that offer scalable, secure, and innovative solutions while keeping up with financial regulations are more likely to succeed in the highly competitive fintech market.

2. How does AI enhance fintech software development?

AI enhances fintech software development by automating complex processes such as fraud detection, personalized financial advice, and risk management. AI-driven software can analyze large datasets in real-time, making financial operations more efficient and secure.

3. What are the top services offered by fintech software development companies?

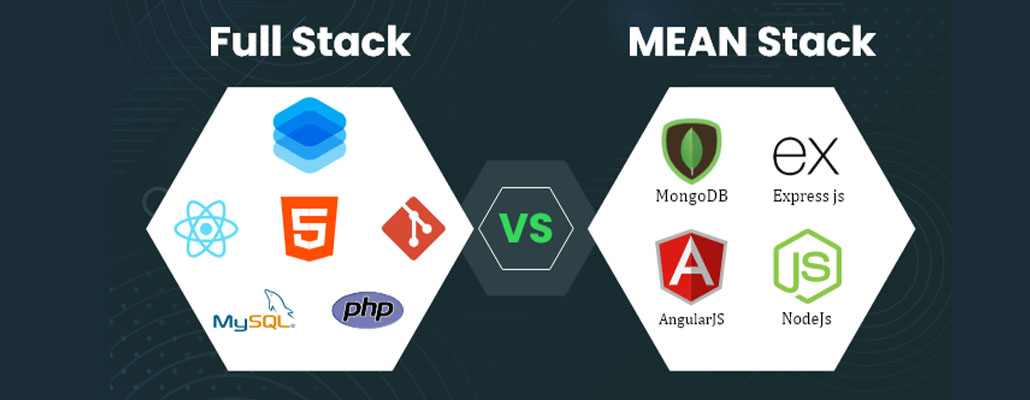

The top services include digital banking solutions, blockchain development, AI-driven financial tools, automated trading platforms, and mobile payment gateways. Many fintech companies also offer API integration and custom software solutions tailored to the needs of financial institutions.

4. Why is Tangent Technologies considered a leader in AI fintech solutions?

Tangent Technologies is considered a leader in AI fintech solutions because of their focus on integrating advanced machine learning algorithms into financial software. Their AI-driven solutions improve security, automate workflows, and provide personalized financial experiences for end users.

5. How can fintech software development benefit small businesses?

Fintech software development benefits small businesses by providing cost-effective solutions for managing finances, processing payments, and enhancing customer experiences. With fintech software, small businesses can automate many processes, reduce human error, and compete with larger enterprises in the digital financial space.