How Digital Transformation is Driving Innovation in Banking

Banking is one of the greatest industries worldwide and a very fruitful profession. The banking industry is changing radically because of digitalization and the growing competition from technology-based organizations. As more of the population becomes comfortable with digital services, banks have no choice but to update themselves to remain relevant. In this blog, we will discuss the importance of digital transformation in banking. Our core focus will be on the change from conventional to Internet banking. We will discuss the problems that banks face in their efforts at transformation.

Digital Transformation of Banking Industry and its Importance

It has never been as vital for the banking industry to acquire digital transformation and adopt new practices. Banks, especially the conventional ones, are under pressure from financial technology firms and new-generation banks that seek to deliver unique value propositions to customers. With the increasing trend towards internet and mobile banking, the banks have to change their course of operation.

Traditionally, banking was all about physical buildings and long lines of people waiting in queues to sort out their financial needs. However, provided the fact that mobile applications are now more popular than ever, customers expect companies to provide more effective services that can be accessed via their mobile devices. Banking customers demand a range of services, such as online payments, credit applications, and bill settlements, and they all should be easily accessed. Understanding the shifts, financial institutions are focusing on digital strategies, with as many as 46% of the banks shifting to mobile banking as their main goal.

Understanding the Fundamentals of Digital Transformation in Banking Industry

Banks today are in the process of continuously changing their operations in line with the digital age. Banks have to primarily focus on customers and be innovative in all spheres of their work.

1. Setting Clear Objectives

The first activity in digital transformation is determining the objectives and the expected results of the process. Banks should understand the current state, define what is missing and define the future state.

2. Defining Success Metrics

To track the progress and define the effectiveness of the digital transformation, the banks need to set up KPIs corresponding to the strategic objectives. Such could be revenue growth, digital, customer, and operational number which may include revenue, mobile, customer, and operational numbers.

3. Understanding Customer Needs

Banks need to plot the customer journey to identify the customers’ behavior, needs, and concerns. This enables them to develop digital products and services that are inline with customers needs and wants.

4. Changing Organisational Culture

Digital transformation means a change of culture at every level of the organization. It is imperative that leaders encourage a culture of innovation and encourage employees to embrace the change by following its objectives to the latter.

5. Attracting the Right Talent

Banks need to ensure that they attract qualified employees with knowledge in the new technologies. Working with IT staff augmentation companies is useful when it comes to filling the skills gap and boosting transformation programs.

6. Continuous Improvement

This is not the end of the transformation process when new technologies have been implemented. Banks need to track performance, collect feedback, and adjust activities to maintain positive results and outcomes in the long run.

Technology as the Foundation for the Digital Transformation of the Banking Sector

Technology is a pivotal factor in supporting the process of digital transformation in banking. It offers the platform, platform, and platforms that are required for the transformation of the banking sector and improving its performance. For the banks to remain relevant, they need to adopt technologies such as cloud computing, APIs, AI and blockchain.

- Cloud computing enables the consumption of computing resources and services by banks as and when needed and also breaks down functional silos. It can facilitate quick service introduction, thus allowing the uninterrupted provision of service to clients.

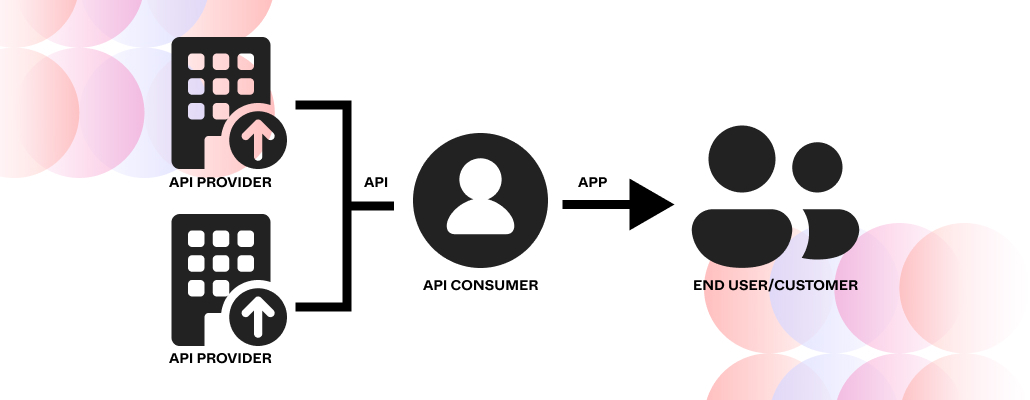

- AAPIs (Application Programming Interfaces) are interfaces that enable the banks to communicate with other applications to provide new digital services. APIs are safe ways that allow the flow of information between banks and fintech companies and other counterparts.

- Digital is advanced by AI in the trend by making new opportunities to improve performance, protection, and satisfaction. The AI solutions in banking include; fraud detection, customer relations, credit risk, and chatbots for round the clock services.

- Blockchain is an open, distributed database that records transactions and enhances security and fight against fraud. Due to the security of the system, it can be applied for banking data storage and make the transactions more transparent.

At Tangent Technologies, we’re helping banks innovate through digital transformation.

Let’s work together to bring some smarter ideas and faster solutions to your customers.

Connect with Tangent Technologies Today.

Conclusion

"The digital revolution is forcing banks to fundamentally rethink how they interact with customers, deliver services, and compete."

In this fast growing society and technological development, all fields and all careers are computerized. Now there is more robotic (AI) work and less human tasks. By using digital technologies, the banks may enhance the focus on the customer, create more innovation, and gain a significant competitive advantage. Here we discuss various aspects of digital banking in this blog. Still, there are some problems, also, there are several disadvantages, yet, this shift is a positive change that has more benefits.

FAQ’s

1. What can be predicted about the future of digital transformation in banking?

Over the next few years, we will see more and more use of data and its analysis, as well as automation, to create better customer experiences by offering more targeted and timely services.

2. Which factors should be considered in the context of digital transformation in banks?

The key success factors of digital banking transformation strategy are on the customer-oriented approach, advanced data analysis, and data security.

3. Which technologies are at the heart of digitalization in the banking industry?

The primary enablers of digital transformation in banking include:

1. Artificial Intelligence,

2. Blockchain,

3. Robotic Process Automation (RPA),

4. Big Data Technology

4. How can banks incorporate artificial intelligence and machine learning in their digital strategies?

The use of AI and ML is being adopted in the banking sector to support chatbots and virtual assistants for round-the-clock customer support, to manage huge data sets for the identification of frauds and credit scoring, and also to automate some of the banking processes to save time.