Fintech Innovations: How Technology is Reshaping Banking and Finance?

In the ever-evolving digital world, traditional ways of life are being transformed and revolutionized in ways no one ever thought was possible. Financial sector is no exception. Technology has seeped into all aspects of life from waking up in the morning to going back to sleep, we are surrounded by technology in one way or another. Fintech is one of the marvels of technology. In this blog, we will discuss the innovations in fintech and how fintech banking and fintech finance is reshaping our perceptions of financial marketplace.

What is Fintech?

Fintech, short for financial technology, is all about using modern technology in finance. Ditching the old-school traditional banking systems that used to require hours to get the job done, technology brings fintech solutions by bringing digital platforms, apps and other technology-driven fixes that make financial services more accessible and convenient for everyone to use. Tech in banking and finnace has changed the way we used to make our payments. You do not need to go the bank physically, instead you can use online mobile banking apps to make payments directly from your phone.

The Rise of Digital Payment

Instead of using cash or cards, the use of digital payments is on rise. The digital payments solutions are quick, easy and secure. There are mobile payment apps and then there are peer-to-peer payment platforms; where you can send money to friends and family instantly. Digital wallets store your payment information securely and is available to use when you want to make an online purchase without needing to put in your card details every single time.

Blockchain and Cryptocurrency

Blockchain is like a digital ledger that keeps track of transactions, and it's the backbone of cryptocurrencies like Bitcoin and Ethereum. Instead of relying on a central authority like a bank to verify transactions, blockchain uses a network of computers to record and confirm them. This makes transactions transparent and impossible to change once they're recorded. Cryptocurrencies, like Bitcoin and Ethereum, are digital currencies that use blockchain technology. They offer different ways to invest and manage money outside of traditional banks. For example, you can use cryptocurrencies to invest in new projects, send money across borders without high fees, or even lend and borrow money without a bank being involved.

Roboadvisors

If you do not know alot about investing and are not willing to spend your hard earned bucks on financial advisors, roboadvisors are here to help. Roboadvisors leverage artificial intelligence and algorithms to look at your personal preferences and goals for investing and then give you advice tailored for you. Roboadvisors are efficient in decision making since the human biases are being minimized therefore they make decisions based on data and facts.

Alternative Lending and Crowdfunding

When it comes to borrowing money, fintech has brought some revolution here as well. Now, it's easier for people to get loans through peer-to-peer lending and crowdfunding. Instead of going to a bank, these platforms connect people who want to lend money directly with those who want to borrow it. This makes the process faster and sometimes cheaper.

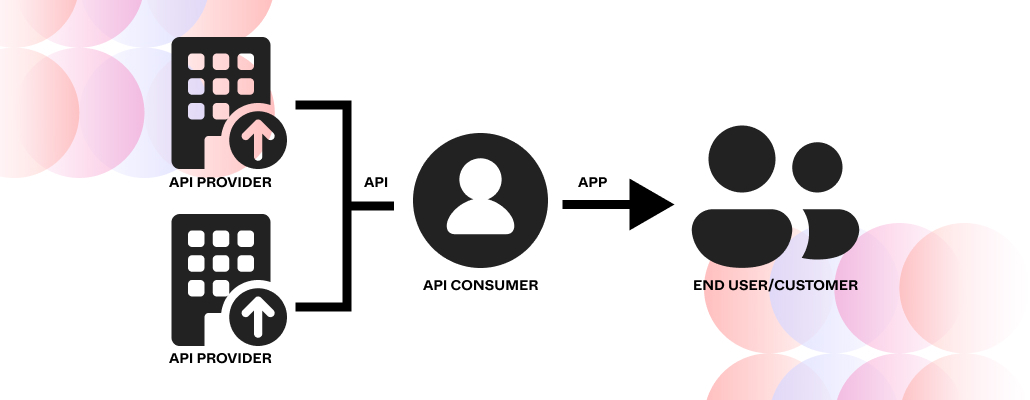

Open Banking

Open banking allows banks and financial institutions to share the customer financial data securely with other authorized third-party providers through the use of application programming interfaces (APIs). This sharing of data allows customers to give permission to their bank to share their information with other banks. This allows better financial management and enhanced customer experience.

Conclusion

In conclusion, tech in finance is changing the way we manage money, not only making it quicker but cheaper as well. Digital platforms have transformed the experience of financing through direct payments from mobile and investing without the need to go to a bank. Innovations in Fintech are making traditional banking systems adapt to fast paced world of everchanging digital landscape.

FAQs

1. What is fintech?

Fintech, short for financial technology, refers to the integration of technology into financial services to improve efficiency, accessibility, and innovation in banking and finance.

2. How is fintech reshaping banking and finance?

Fintech innovations are revolutionizing traditional banking models by introducing digital payments, blockchain technology, robo-advisors, alternative lending platforms, and more. These advancements enhance convenience, reduce costs, and democratize access to financial services.

3. What are some examples of fintech innovations?

Examples of fintech innovations include mobile payment apps (e.g., PayPal, Venmo), blockchain-based cryptocurrencies (e.g., Bitcoin, Ethereum), robo-advisors (e.g., Betterment, Wealthfront), peer-to-peer lending platforms (e.g., LendingClub, Prosper), and Regtech solutions for regulatory compliance.

4. How do fintech solutions benefit consumers?

Fintech solutions offer consumers greater convenience, accessibility, and customization in managing their finances. They provide faster and cheaper payment options, personalized investment advice, easier access to credit, and enhanced security through advanced technologies.

5. How are traditional banks responding to fintech innovations?

Traditional banks are adapting to fintech innovations by investing in digital transformation, partnering with fintech startups, and launching their own digital banking platforms. Many banks are also embracing open banking initiatives to collaborate with third-party developers and offer innovative financial products and services.